- Dividend payouts in Europe projected to increase by 6.5% to EUR 433 billion in 2024, dividend yield for Europe also on the rise.

- Allianz Global Investors Dividend Study 2024 highlights the significant contribution of dividends to the overall performance of European equities.

- Dividends' stabilising effect on the overall portfolio should not be underestimated.

16 Jan 2024 | Dividend payouts for the MSCI Europe have once again reached record levels: according to calculations by Allianz Global Investors, the dividend payouts of companies in the broad European equity index MSCI Europe totalled around EUR 407 billion in 2023. For 2024, dividend payments are expected to total around EUR 433 billion. This corresponds to an increase of around 6.5% compared to 2023. By 2025, dividend payments are even expected to total EUR 460 billion (+13% compared to 2023).

Jörg de Vries-Hippen |

Jörg de Vries-Hippen, Head of Investments Equity Europe, says: "The recent increase in dividend payments brings us almost back to pre-pandemic levels - another step towards normality. The outlook also remains positive: dividend payments are expected to grow both this year and in the year ahead. Grant Cheng, Portfolio Manager Dividends, adds: "There are, however, strong differences at sector level, which argues in favour of diversification and selection when making investment decisions. Dividend payouts are rising particularly in the financials and consumer discretionary sectors."

Grant Cheng |

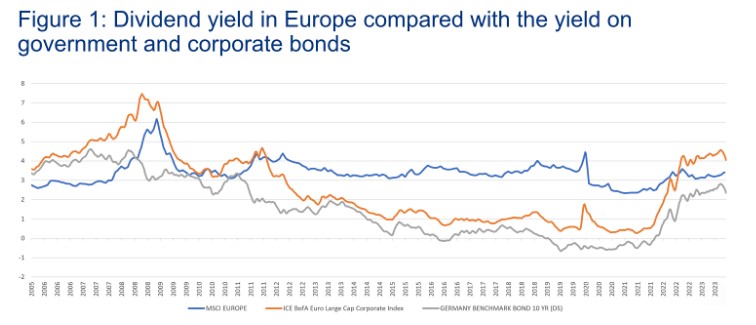

The dividend yield is following a positive trend as well. Dividend yield represents the percentage payout in relation to the current share price. For MSCI Europe companies, it stood at 3.47% at the end of 2023 and could rise to 3.67% this year. This puts the dividend yield well above the yield on long-term German government bonds - despite a sharp rise in yields on these in 2022. German companies included in the MSCI recorded a dividend yield of 3.3% for the past year - with 3.53% expected for 2024. Companies from Norway remain at the top of the European ranking despite expected declines: The dividend yield decreases from 7.2% for 2023 to 6.4% for 2024.

Allianz Global Investors Dividend Study

The importance of dividend distributions for the total return of equity investments is demonstrated by the Allianz Global Investors Dividend Study by taking a look at the past. Over the last 40 years, almost 36% of the annualised total return on equity investments for the MSCI Europe was driven by the performance contribution of dividends. In North America (MSCI North America) and Asia-Pacific (MSCI Pacific), 22% and just under 41% of the overall performance respectively is attributable to dividends.

Dr. Hans-Jörg Naumer |

In the recent past in Europe, dividend payments have contributed strongly to the overall performance of equities. From 2019 to 2023, dividend payments at 2.51% made up almost half of the overall performance of 5.13%. From 2014 to 2018, they even accounted for the vast majority at 2.75% of 2.96%.

The share prices of companies that pay dividends have also proven to be less volatile in the past than shares of companies that do not pay dividends. "The general rule of thumb is: company profits fluctuate less than share prices, dividends fluctuate less than company profits," Hans-Jörg Naumer summarises.