You will find below a commentary by Dong Chen, Chief Asia Strategist and Head of Asia Research at Pictet Wealth Management, on the Bank of Japan's decision to abandon its negative interest rate policy.

- As widely anticipated prior to the March policy meeting, the Bank of Japan (BoJ) made significant changes to its monetary policy framework. In short, the BoJ put an end to the negative interest rate policy (NIRP), and removed the yield curve control (YCC), but will continue to maintain a accommodative policy stance through bond purchases. There is no indication for further rate hikes in the policy statement. Apart from some technical details, most of these changes are in line with our expectations. Post the announcement, yen weakened and Japanese equities gained.

- The main significance of today’s changes is that the BoJ is no longer constrained by the previous highly restrictive policy framework (although these restrictions have been gradually relaxed over the past year since Governor Ueda stepped in office). And the side-effects created by the NIRP, especially for banks, are removed. As we argued before, these are the main objectives that the BoJ hoped to achieve, instead of conducting monetary tightening.

- Under the new policy regime, the BoJ will move towards more ‘traditional’ policy tools such as short-term interest rate. In line with this change, the uncollateralized overnight call rate will be the new policy rate (as opposed to the interest rate on banks’ excessive reserves under the previous regime), which will be hiked by 10bps to the range of 0% to +0.1% from the previous -0.1% to 0%.

- The BoJ is no longer committed to maintaining any yield target for the 10-year JGBs, which indicates the end of YCC. But the BoJ will continue to purchase JGBs with “broadly the same amount as before”. In addition, “[i]n case of a rapid rise in long-term interest rate, it will make nimble responses by… increasing the amount of JGB purchases and conducting fixed-rate purchase operations of JGBs”. In other words, the BoJ is free to conduct bond purchases at its will without any prior commitment on either price or quantity. This allows the BoJ a lot of flexibility manipulating (as opposed to “controlling”) the yield curve without restrictions. In this sense, YCC is not completely gone.

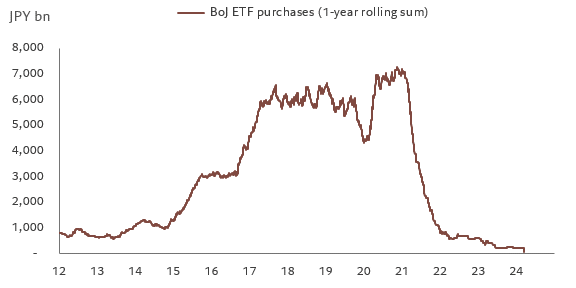

- The BoJ will also discontinue its purchases of Japanese equity ETF and J-REITs. Since 2021, the BoJ’s purchases of equities and J-REITs have dropped sharply and reached negligible levels lately (Chart below). Hence the discontinuation of these purchases will unlikely have no impact on the market in the near term.

- The BoJ provides little forward guidance on future policy. It says it will continue to pay attention to developments in financial and FX markets, and their impact on Japan’s economic activity and prices. Notably there is no indication of further rate hikes in the statement.

- So overall, the BoJ’s latest policy changes did not bring many surprises, and the impact on the market is fairly small, which is what the central bank had tried to achieve, in our view. Looking forward, while we believe there might be some room for the BoJ to hike interest rate further in the long run, the BoJ will likely proceed very carefully and gradually. For the time being, we do not expect any further rate hikes in 2024.