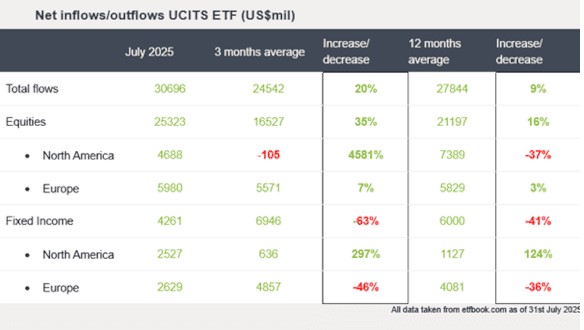

2025 remains a volatile market environment for ETFs*. Specifically, ETFs focused on the US either suffered significant outflows (-1.5 billion USD in June) or saw large inflows (+10 billion USD in January) in different months. But with +4.6 billion USD inflows, July was a successful month once more. Both the overall ETF market (+30 billion USD) and equity ETFs (+25 billion USD) grew more than the past three months, compensating for the below-average growth in bond ETFs.

"Relaxing signals in US trade policy once again impacted the ETF market. ETF investors looked more optimistically at the US in July and bought," says Stefan Kuhn, Head of ETF & Index Distribution, Europe at Fidelity International. In the past month, President Trump announced a 90-day pause in the trade conflict with the EU and China and the USA agreed an end to certain trade restrictions. "The question will be whether the pattern repeats and the newly agreed deal between the US and the EU once again favours ETFs focused on the US," says Kuhn. However, a lesson from the past few months is how volatile the market has been this year. "Recently, the mood in the markets has clouded somewhat again. How ETF investors will react to this will become apparent in the coming weeks."

Market event of the month: The stable growth of the ETF market

"After two extremely strong months for bond ETFs, the rotation recently shifted back towards equities. To me, this means that markets are becoming more risk-tolerant," says Kuhn. It is also interesting that bond ETFs focused on Europe recorded more inflows throughout the year than US ETFs. In the shadow of all the short-term discussions on trade policy and sector rotations, investors should not lose sight of long-term developments. "The overall ETF market continues to grow extremely steadily," says Kuhn. This speaks to the great confidence investors have in the ETF as an investment vehicle. An end to this development is not in sight," concludes Kuhn.