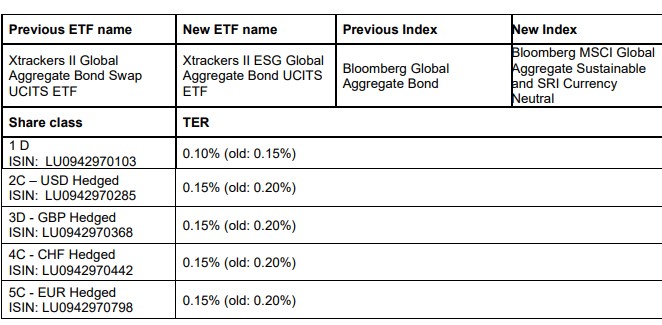

DWS has made the Xtrackers II ESG Global Aggregate Bond UCITS ETF launched in 2014 more attractive for investors. The ETF (see table below for details) continues to offer broad coverage of all major bond segments with investment grade ratings from the leading rating agencies. However, due to an index change, comprehensive criteria for environmental and social standards as well as for good corporate governance (Environment, Social, Governance; ESG for short) are now additionally observed.

The "Bloomberg MSCI Global Aggregate Sustainable and SRI Currency Neutral" index excludes, for example, issuers that are active in controversial sectors such as alcohol, tobacco, military or civilian weapons or gambling and breach certain revenue thresholds. This also applies to issuers involved in the extraction or processing of coal, oil or gas. All issuers eligible for inclusion in the index must also have an MSCI ESG rating of "BBB" or higher. The underlying index with ESG criteria contains around 13,000 bonds, less than half as many as the previous "Bloomberg Global Aggregate Bond" index.

At the same time, index replication has been switched from synthetic to physical. DWS is thus following the preference of many investors who prefer a physical index replication. Also, the ETF's fees have been reduced in order to pass on to investors the cost advantages of high inflows in past years. Currently, the ETF has around EUR 570 million1 in assets.

"In our view, the Xtrackers II ESG Global Aggregate Bond UCITS ETF offers a very attractive combination for investors who want to track the entire investment-grade bond market with just one ETF, and at the same time stringently comply with sustainability criteria," says Simon Klein, Head of Passive Sales at DWS . "This is a very good example of how we continue to develop our ETFs to meet investor needs.