Marc-Antoine Collard, Chief Economist & Head of Research Rothschild & Co AM

Soft patch in Q1 2022

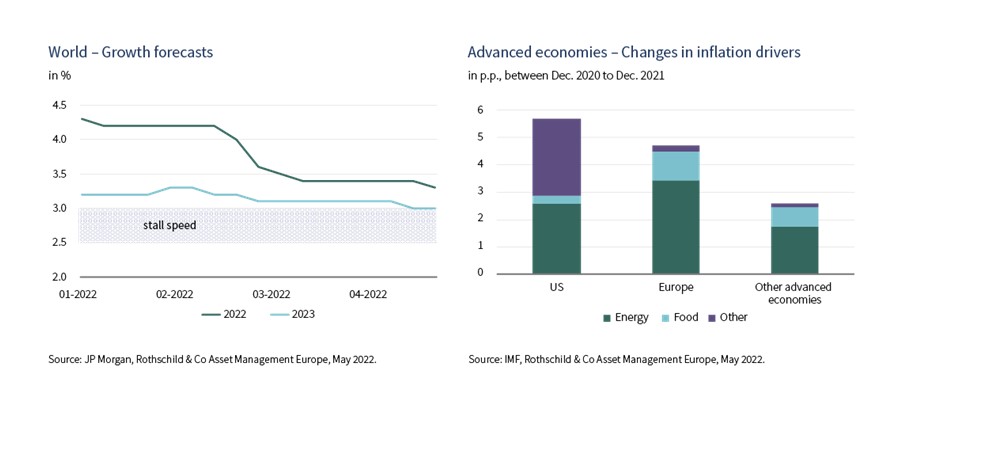

Eurozone GDP posted positive but sluggish growth in Q1 2022 of 0.2% q/q compared to 0.3% in Q4 2021. Italy (-0.2%) and France (0%) underperformed while Germany escaped a technical recession with a 0.2% rise after -0.3% in the prior quarter(1). Despite the post-Omicron services recovery, the overall weakness reflects the impact of the Ukraine war as households’ real incomes are being squeezed by high inflation. Although the latter is mainly explained by a sharp rise in commodity prices, hence mostly outside the realm of monetary policy, several ECB Governing Council members nonetheless spoke out in favour of a more hawkish policy stance and investors have priced in three 25 bps hikes in 2022.

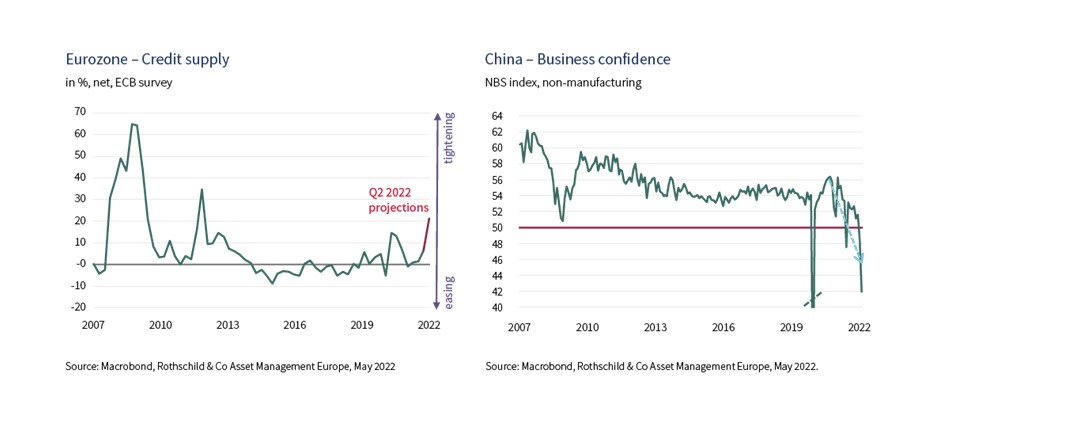

According to the April S&P Global(2) (ex-Markit) business confidence survey, a renewed surge in costs, due to higher energy prices and further upward pressure on prices paid for many other inputs amid shortages, led to the steepest rise recorded in at least 20 years in the producers’ selling prices sub-index. In fact, despite the lowest unemployment rate in decades, household confidence is plummeting, which could result in a consumer-led sharp economic slowdown. In addition, the latest ECB lending survey revealed a large number of banks expect standards for businesses to become tighter in Q2 2022 on the back of the Ukraine war and monetary conditions tightening, adding to a cooling investment environment in the eurozone. Looking ahead, risks to growth are to the downside and will in part depend on developments regarding Russia’s energy supply to Europe, leaving the ECB stuck between a rock and a hard place.

Meanwhile, US GDP contracted -0.4% q/q in Q1 2022 (or -1.4% annualised), disappointing expectations for a 0.3% pace of expansion(3). While consumer and business spending were buoyant during last quarter, much of that demand growth was met by foreign production, as imports surged at a 17.7% annualised pace. Aside from foreign trade headwind, government spending also contracted for a second quarter in a row. But from the perspective of gauging the health of the expansion, private domestic demand was robust despite the headline disappointment and accordingly, the Fed is unlikely to veer from its path of hastily tightening its policy, especially as signs of an overheating labour market are mounting. Indeed, recent data suggest elevated inflation has become sufficiently salient to alter wage and price settings as the employment cost index – one of the best labour cost pressure indicators – showed private sector wages up 5% y/y in Q1 2022, its fastest pace since 1984(4).

Will inflation peak soon?

Even prior to the invasion of Ukraine, inflation had surged in many economies because of pandemic-induced supply-demand imbalances, but also because of soaring commodity prices. War-related interruptions to production, sanctions and strongly impaired access to cross-border payment systems have disrupted trade flows, notably for energy and food, thus adding further upward pressure on prices. In some advanced economies, including the US and some European countries, inflation has reached its highest level in more than 40 years and there is a rising risk that inflation expectations become de-anchored.

Hence, central banks continue to pivot towards more rate hikes, and the debate on how far rates will need to rise has intensified. Investors expect a more substantial and broad-based deceleration in inflation in H2 2022 as bottlenecks related to the pandemic fade and labour supply improves modestly, which could give central banks room for manoeuvre to pause somewhere later this year. However, a high level of uncertainty surrounds this forecast, especially as supply chains come under renewed pressure amid the drag from Covid building in China.

Biggest short term risk has shifted to China

According to the latest NBS business confidence index, China’s economic activity contracted sharply again in April due to closed factories and lockdowns in Shanghai and other areas to contain the rise in new Covid-19 cases. The non-manufacturing index, which measures activity in the construction and services sectors, remained in contraction territory and plunged to 41.9 from March’s 48.4, hitting the lowest level since the first year of publication in 2006 – with the sole exception of February 2020.

The risks stemming from the Chinese slowdown are multiple. First, slowing activity in China will affect the global economy as it represents almost 20% of world GDP. Second, weak domestic demand will temper exports to China from its trading partners. Third, slowing in both China production and shipping is going to disrupt global supply chains. Incidentally, the increasing strain on global bottlenecks is becoming apparent, with the NBS manufacturing sub-index data showing suppliers face the longest delays since 2005 – again with the only exception of February 2020.

Recently, China’s daily new cases appear to have plateaued, but only because of severe lockdowns. In fact, the potential for the world’s largest manufacturer to experience repeated on-again, off-again states of paralysis is sinking in. China’s Politburo has reiterated its 5.5% GDP growth target for 2022 and stressed further policy support will be forthcoming. Indeed, while most economies are tightening monetary policies amid high inflationary pressures, China is doing the opposite, and more easing is expected due to the sharp deterioration of the economic outlook. However, it is hard to see how the authorities can reach their growth target and simultaneously keep its zero-Covid policy in place.

Meanwhile, the yuan is depreciating fast against the USD amid a hawkish Fed. Although Chinese policymakers have clearly signalled their discomfort with the speed of this move, tolerance for gradual depreciation may remain part of the policy toolkit to support economic growth. More broadly, the USD has appreciated strongly amongst most currencies, reaching the top of its range over the past two decades, thus contributing to the tightening of global financial conditions.

Overall, renewed lockdowns in China’s major economic hubs, geopolitical instability stemming from the conflict in Ukraine, high commodity prices and a tightening in global financial conditions will continue to weigh on the global economy. While drivers of high consumer prices are in many cases beyond the control of central banks, elevated inflation could persist for longer, exacerbating a difficult monetary policy trade-off between tackling it and safeguarding the recovery as China risks sub 4% growth and a threat of recession in Europe.

(2) Source: Purchasing Managers’ Index, an indicator reflecting the confidence of purchasing managers in a sector of activity. Above 50, it expresses an expansion of activity, below 50,a contraction.

(3) Source: BEA, May 2022.

(4) Source: Bureau of Labour Statistics, May 2022.