The environment remains tough for fixed income investors. Hopes that a peak in rates was hit in early May proved short-lived with the US 10-year subsequently surging once more to fresh highs. Persistently high inflation continues to drive fears that central bank tightening will remain aggressive.

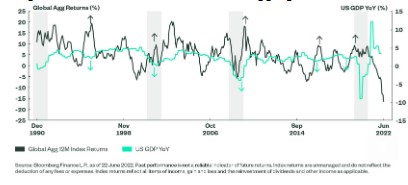

However, the narrative has shifted, and the markets now believe there are risks that central banks may try too hard to squeeze inflation, tipping the global economy into recession. This ‘double jeopardy’ of rising underlying yields and wider credit spreads, as a result of growth fears, has resulted in particularly poor performance for aggregate fixed income strategies. The Bloomberg Aggregate Index is down 14.3% year to date.

Timing the turn

Jason Simpson Senior Fixed Income Strategist at State Street SPDR ETFs: “The big question for fixed income investors, as they position for the third quarter, is whether we have arrived at a peak in yields. It is notable that the 5-year, 5-year forward rate in US Treasuries is now back in the range seen in 2018, the last time the US Federal Reserve was in tightening mode. So, a reasonable upward shift in longer-term rate expectations has occurred.”

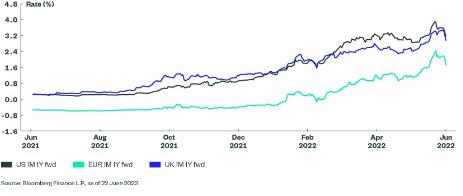

Figure 1: 1-Month Rates 1 Year Forward have Retraced from the Highs

At the front end of the curve there are also signs that the market has reached the stage where it feels that further tightening of policy, beyond that already priced in by markets, will precipitate an even greater chance of a recession.

Figure 1 shows 1-month interest rates in 1 year’s time, which is a proxy for the amount of policy tightening that the market believes will be delivered over the coming 12 months. There has been a decisive turn lower from the spike seen in mid-June. This is the case even for the euro money markets where the ECB has yet to deliver a rate rise and hints that the market is struggling to price in an even more aggressive path for rate rises. This should provide a near-term cap on yields until the path of the economy becomes clearer.

Questions will also revolve around the degree of credit risk that investors may want to take. US high yield, which yields more than 8.5%, may be appealing but will not perform well if we head into a recession in the coming 12 months.

As the May ‘head fake’ in bonds illustrates, trying to time the turn in markets is tricky. However, broadening the invested pool of bonds, by following strategies such as global aggregate, may be an effective way capturing the turn when it arrives.

Three important areas for investors to consider when looking at global aggregate bonds.

Figure 2: US Recessions and Global Aggregate