Every year, candy is bought in bulk to supply hungry trick-or-treaters and petrifying parties during Halloween. This spooky season, Saxo has analyzed candy companies and shared their performances over the last five years.

As October comes to a close, “Spooky Season” is well and truly underway. The Halloween period is a treat for horror film producers, pumpkin farmers and, perhaps most of all, candy companies.

Every year, candy is bought in bulk to supply hungry trick-or-treaters and petrifying parties, and many companies even release special Halloween-themed treats.

With this in mind, we analysed which candy companies are thriving in market performance over the last five years.

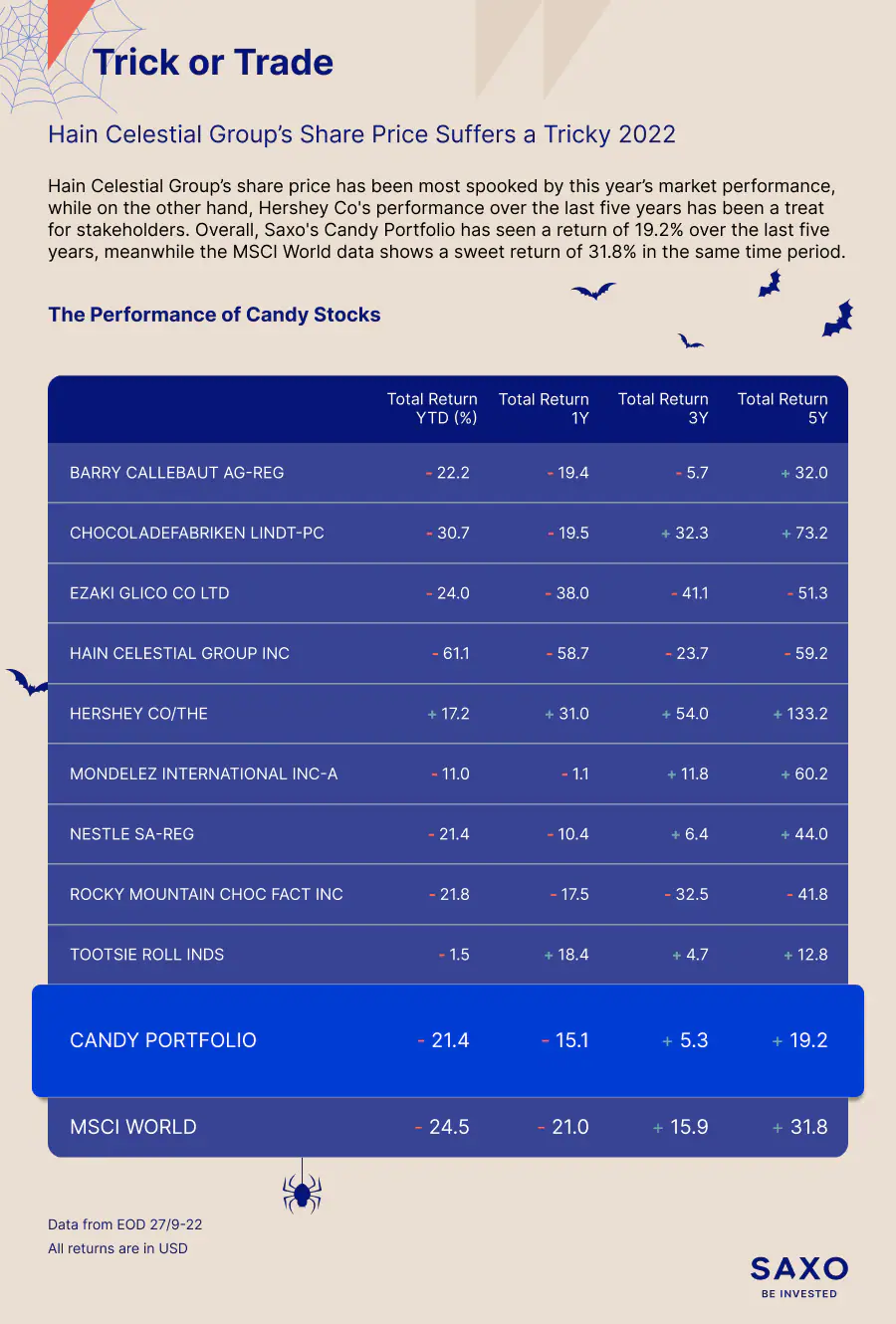

Only The Hershey Company Company has registered positive returns in the past year, registering a sweet 17.2% return. Tootsie Roll Industries placed second in the year to date. As for Mondelez International , the company that produces classic confectionaries such as Sour Patch Kids and Oreos, has had a -11% return so far in 2022.

Hain Celestial Group Inc has suffered a spooky year so far with a -61.1% return. The company, which mainly focuses on natural foods and own brands such as ParmCrisps, Thinsters, and Garden of Eatin', also finished bottom for their returns in the last year (-58.7%) and returns over the last five years (-59.2%).

When looking at the last year, The Hershey Company Co once again topped the list with a total return of 31% and they also lead the way in the last three years too (54%).

Tootsie Roll and Tootsie Pops producers, Tootsie Roll Inds has enjoyed a strong showing over the last 12 months with a return of 18.4%. Meanwhile, Swiss chocolatiers Chocoladefabriken Lindt , who are famous for their Lindor brand and their seasonal confectioneries, have enjoyed a tasty last three years with returns of 32.3%. Japanese company Ezaki Glico Co., Ltd. has had a frightening last three years and was ranked as the worst-performing candy company in this period, showing returns of -41.1%. The food processing company based in Nishiyodogawa Ward, Osaka, Japan, works with products such as confectionery, dairy, ice cream and even baby formulas. Their sweeter products include Japanese snacks Pretz and Pocky. The Hershey Company Co See Returns of 133.2% in the Last Five Years The Hershey Company Co, who owns the licence to produce KitKat bars in the US, have given stakeholders a big break, as they topped candy companies’ performance over the last five years too with a huge return of 133.2%, and they were followed by Chocoladefabriken Lindt who had strong returns of their own.

Swiss company Nestlé, which produces chocolate such as the Aero and The Lion Bar, has seen roaring returns of 44% over the last five years. Cocoa processor and chocolate manufacturer Barry Callebaut had slightly lower returns of 32% in the same time frame. The Belgian-Swiss company owns brands such as American Almond, Bensdorp, and Mona Lisa.

Colorado-based Rocky Mountain Chocolate Factory a slightly sour last five years with returns of -41.8%. Traded as “RMCF”, the company went public in 1985 and operates in the United States, Philippines, Panama, and South Korea.

Candy Portfolio vs MSCI World

Interestingly, Saxo’s candy portfolio has outperformed the MSCI World Index in the year to date and the last 12 months. However, this has not been the case when looking further back. The MSCI World Index (which can be traded via select exchange traded funds) showed returns of 15.9% over the last three years and an even more impressive 31.8% return when looking at the last five years.