By Peter Garnry, Head of Equity Strategy at Saxo

Peter Garnry |

European real estate companies are down 43% since December 2021 as higher interest rates are reducing their asset values and over time increasing their interest expenses eating into their operating cash flows. The industry is valued at a low price-to-book of 0.7x suggesting the market is expecting a serious deterioration in assets and cash flow performance. The current average EU mortgage rate was 3.1% in January and if the mortgage rate goes to 5% as in 2007 then real estate companies will increasingly spent the majority of cash flows on servicing their debt leaving little value for shareholders

Real estate was not the yield amplifier as advertised

Real estate stocks were again the weakest industry group down 3.3%. Our focus today is European real estate. Years of low interest rates in Europe increased significantly house prices with more than 50% on average since Q1 2014 according to Eurostat figures. In countries such as Sweden the increase was closer to 65%. The low interest rate environment forced investors to seek yields wherever they could find it and more illiquid alternatives such as real estate saw massive inflows of investor capital.

ECB’s rate hike from 0% to 3.5% at the latest rate decision this month has caused new borrowing for residential houses to fall sharply and many homebuilders have seen a 75-80% plunge in new orders. The average EU mortgage rate increased to 3.1% in January according to ECB figures. Higher interest rates have pushed European real estate companies down by 43% since December 2021 with the STOXX Europe 600 Real Estate Index down 31% over the past five years compared to 31% gains in the broader European equity market. Real estate investments turned out on average to not be the return amplifier that many investors had hoped for.

Is real estate the next risk coming for banks?

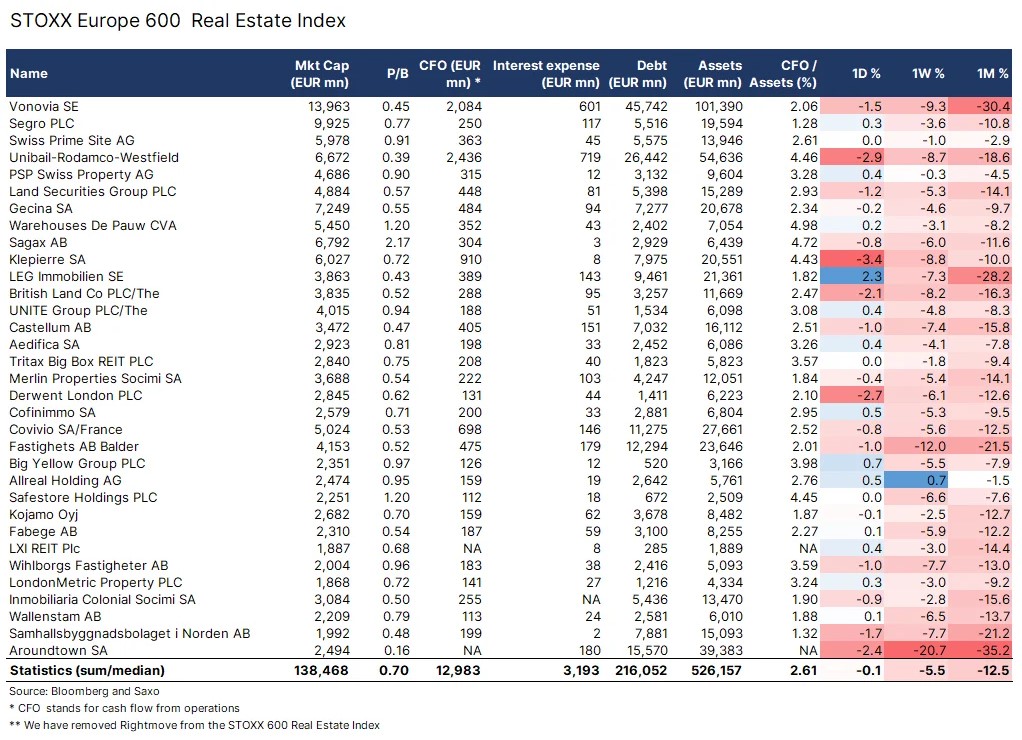

The 33 real estate companies in the STOXX Europe 600 Real Estate Index represents €138bn in market value and sit on total assets of €526bn. These asset values are no longer reflective of the true value which can be seen by the price-to-book ratio which has fallen to 0.7x for the industry suggesting expectations of falling asset values. This dynamic impacts the collateral value for banks and thus tighter conditions for new lending will happen.

There is a deposit game going on in the banking system which in the case of SVB Financial caused a forced fire sale of assets to pay out fleeing deposits which eventually ended with its failure. Real estate companies can be forced into the same situation if the bank wants these firms to reduce debt levels. Over the past 12 months, these 33 real estate companies have spent around 25% of their operating cash flows on paying interest on their debt highlighting that these companies can easily service their debt at this point.

But as several Swedish banks have recently highlighted the debt service abilities of Swedish real estate companies have deteriorated and will continue to deteriorate. Balder, a Swedish real estate owner, was recently downgraded to junk status on its credit. If we take the largest real estate company in the index, German-based Vonovia , then the weighted average maturity on its debt is around 6.5 years. This means that if mortgage rates stay here at 3.1% or go higher to the 5% level we had before the financial crisis in 2008, then a significant amount of the operational cash flow will be spent on servicing the debt reducing the value for shareholders.