Nadia Gharbi, Senior Economist Pictet Wealth Management.

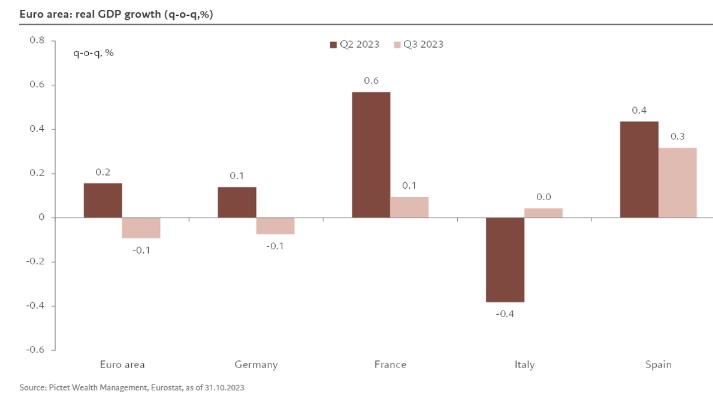

According to Eurostat’s preliminary estimate, euro area GDP fell by 0.1% q-o-q in Q3, while the Q2 figure was revised up to +0.2% q-o-q (from +0.1%). The Q3 number was a bit lower than our expectations (0.0%) but worth noting that excluding Ireland, which contracted sharply in Q3 (-1.8% q-o-q), the euro area print was flat on the quarter. As a number of countries like the Netherlands have not published their Q3 estimates yet, euro area preliminary figure could be revised in the next releases (mid-November and early December).

Country wise, there were downside surprises in Italy and Portugal, while growth rates in Spain, France and Germany were broadly in line with expectations.

A breakdown of euro area Q3 GDP will only be published on 7 December. But we already have some insight into the dynamics at work in individual countries. The drivers appear quite different. In France and Spain, domestic demand was strong, in particular households’ consumption. In Germany, households’ consumption was lower, while investment in equipment contributed positively. In Italy, weakness in activity was due to domestic demand, while net exports contributed positively.

Overall, Q3 figures confirm our view that surveys, in particular purchasing manager indexes (PMIs), have been overexaggerating weakness in euro area activity. Nonetheless, momentum is expected to remain sluggish over the next two quarters. Thus, we are sticking with our euro area GDP growth forecasts of +0.5% in 2023 as a whole, with risks tilted to the downside.

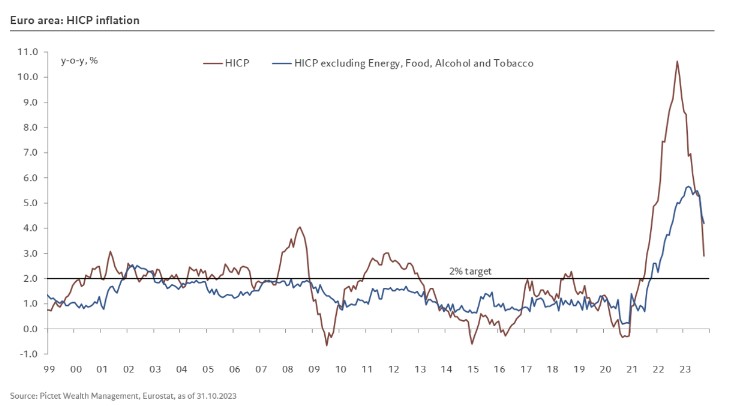

Euro area HICP inflation: headline inflation surprised to the downside

Eurostat's flash estimate of euro area headline inflation eased to 2.9% y-o-y in October from 4.3% the previous month, while core inflation moderated to 4.2% y-o-y from 4.5%.

The details revealed that services inflation eased slightly to 4.6% this month y-o-y from 4.7% in September. Meanwhile, core goods inflation fell by 0.6pp to 3.5% y-o-y in October, reflecting fading pressure from supply-chain issues and energy prices. Aside from core prices, food and energy inflation moderated in October.

All in all, weak demand and base effects are currently pushing down inflation metrics. However, energy prices are set to contribute positively again to headline inflation in the euro area, which could move slightly higher again at the end of the year. But we expect core inflation to continue to ease over the coming months, although at a slower pace. Today’s inflation data support our expectations that the ECB will keep interest rates on hold for the foreseeable future.