By Ole Hansen, Head of Commodity Strategy at Saxo

Ole Hansen |

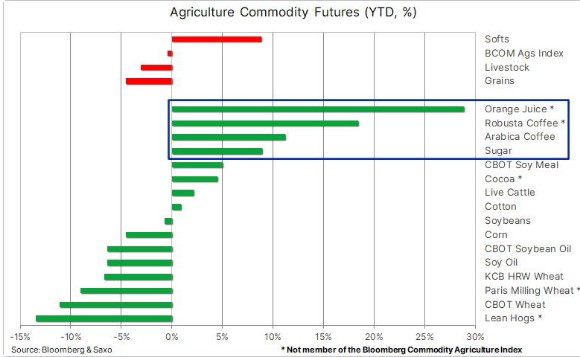

While the energy sector as well as precious and industrial metals have seen the January rally deflate to leave those sectors in the red on the year, the agriculture sector remains resilient with the BCOM agriculture index trading close to unchanged on the year.

Following a strong run up in prices during January, as speculators and traders loaded up on a China recovery theme, these non-agriculture sectors have since been on the backfoot as the focus moved from a slow pickup in demand from China to a loss of risk appetite, driven by macroeconomic developments in the US where recent economic data have shown continued strength in the labor market while inflationary pressures have eased by less than expected.

Continued strength in these numbers have forced the Fed to turn up the hawkish rhetoric, and the market has responded by raising the expected terminal Fed funds rate while at the same time sending bond yields and the dollar higher, thereby hurting risk sentiment across stock markets and the mentioned commodity sectors.

Orange juice, Robusta coffee, sugar, Arabia coffee

Taking a closer look at the different sub sectors within the Bloomberg Agriculture Index, we find most of the gains being concentrated in the soft sector, led by orange juice and Robusta coffee – both non-BCCOM members as well as sugar and Arabia coffee. All supported by tightening market conditions related to developments across their individual growing regions from Florida and Brazil to India and Vietnam. At the other end of the performance table, we find losses across key crops led by wheat, which in turn has spilled over to lower corn prices as well.

Following last year’s surge to a record high that followed Russia’s attack on Ukraine, a major supplier of grains to the global market, a decent northern hemisphere production, not least in Russia, combined with the UN-sponsored grain export corridor from Ukraine have all helped drive prices sharply lower. After hitting record highs last March, the front month wheat futures contracts in Chicago and Paris have lost close to 50% and 40% respectively and currently trade at 17 and 12-month lows.

Russia, the world’s biggest exported is expected to ship a record amount during the second half of the season, while Ukraine is looking for an extension of the soon to expire Black Sea grain-export deal. Combined with a stronger dollar, prices in Paris and Chicago are being forced lower in order to remain competitive with Russian wheat.

Looking ahead to the coming crop year, it is worth noting that the “triple dip” La Niña, which in recent years caused volatile weather developments in key growing regions, appears to be in the final stages, with a transition to neutral ENSO (El Niño Southern Oscillation) levels likely underway. Global climate models, however, call for a shift to El Niño in the Northern Hemisphere summer, potentially reducing extreme heat risks for US crop, but raising the risks of a weaker Monsoon through 2023 for much of Asia and Australia. A phenomenon that typically also improves the chances of rainfall across Southern Brazil through the summer.

Geopolitical fallout on agriculture markets

Overall, the geopolitical fallout on agriculture markets from the Russia’s war in Ukraine will continue to leave the market vulnerable to further disruptions. Ukraine’s corn and wheat production is set to fall for a second year in 2023 and according to Ukraine Grain Association (UGA) the corn output is not expected to exceed 18 million tons and wheat production 16 million tons as farmers reduce production and arable land being inaccessible due to fighting. Overall, Ukraine's grain and oilseed crop output may decline to around 50 million tons from some 67 million in 2022 and about 106 million in 2021, according to UGA estimates.

Together with fundamental support from a recovering China, inflation driving high production costs, weather disruptions potentially impacting production in Asia and Australia, together with tightening fundamentals for sugar, cotton and coffee we see the agriculture sector staying relatively immune to the macroeconomic headwinds currently impacting energy and metals.